The 2025 Global and China International Container Shipping and Digitalization Industry Development Status: International Shipping Services Gradually Enter the Digital Age

Source:前瞻产业研究院2025-05-27

Key data in this article: the scale of global and Chinese maritime trade; global maritime capacity share; global added value of international freight forwarding; global international maritime service platform market size, etc.

Container Shipping Market Analysis

Global Container Shipping Market Analysis

—Stable Growth in Global Shipping

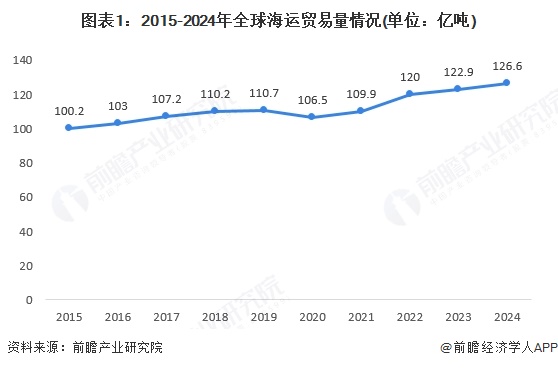

From 2015 to 2024, the scale of global maritime trade has generally shown a steady upward trend. In 2020, due to the impact of the pandemic, global maritime trade experienced its first decline in ten years, but it gradually recovered and developed steadily afterward. By 2024, with the moderate recovery of the global economy and active international trade, the scale of maritime trade is expected to grow, reaching 12.66 billion tons.

——Increase in Bulk and Container Shipping Capacity Share

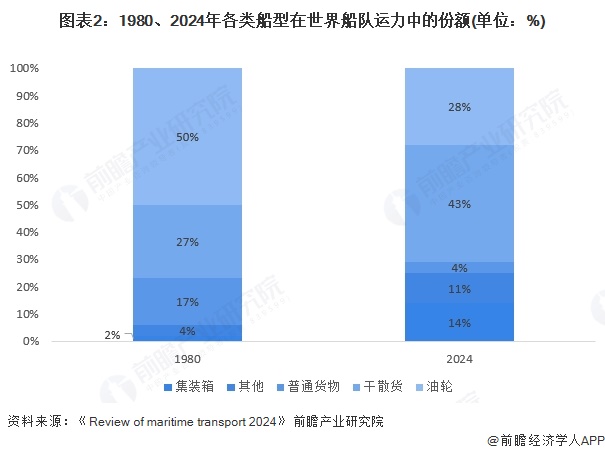

According to the 'Review of Maritime Transport 2024,' in recent years, the share of bulk carriers and container ships has grown rapidly. In 2024, the capacity share of bulk carriers and container ships reached 43% and 14%, respectively.

——Global Economic Recovery Drives Growth in Container Shipping Trade Demand

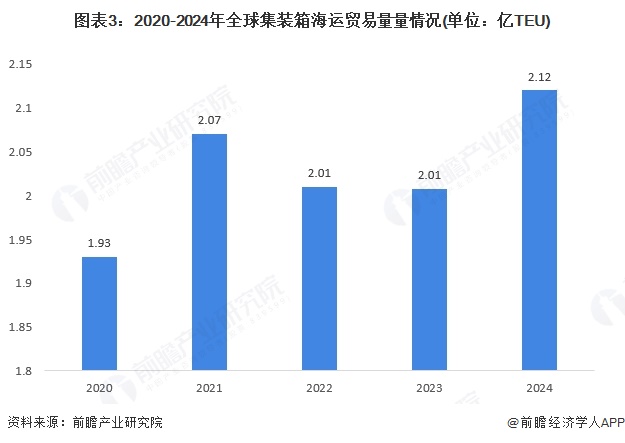

According to IMF forecasts, the global economy is expected to grow by 3.3% in 2025, reflecting a gradual recovery of the global economy. In 2024, the total world container cargo volume is estimated at approximately 212 million TEUs, a year-on-year increase of 5.6%, with growth further expanding. In December 2024, the global container shipping trade index was 126.45, up 3.4% year-on-year, exceeding the average level from 2019 to 2024. Compared with 2023, the growth rate of global container shipping trade has further accelerated, and the shipping trade index has stabilized. It is expected that in 2025, the container shipping trade volume will reach 218 million TEUs, a year-on-year increase of about 2.8%, indicating that the growth rate begins to slow down.

——Intra-Asia routes still account for a significant share of the global container transport market

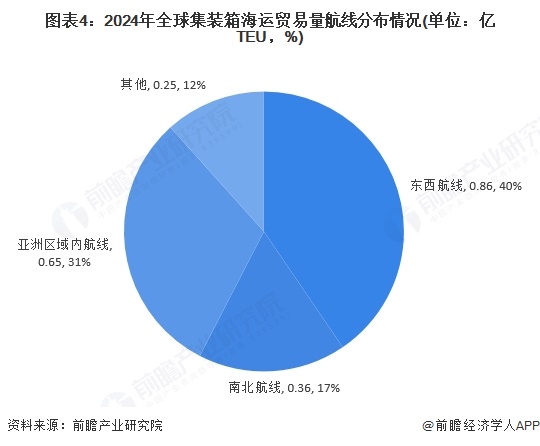

By route, in 2024, the freight volumes for east-west routes, north-south routes, and intra-Asia routes reached 86 million TEUs, 36 million TEUs, and 65 million TEUs, respectively, accounting for 40%, 17%, and 31% of the world’s total container cargo volume. Intra-Asia routes still hold a substantial share of the global container transport market. The distribution of global container shipping trade by route in 2024 is as follows:

Analysis of China's Container Shipping Market

—China's maritime cargo volume has grown year by year, with shipping being the main method of foreign trade

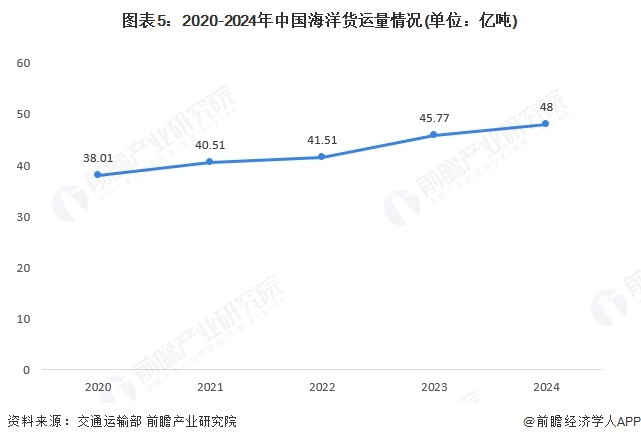

From 2020 to 2024, China's maritime cargo volume has shown a trend of annual growth. In 2023, China's maritime cargo volume reached 4.577 billion tons, and it is preliminarily estimated that in 2024, China's maritime cargo volume will reach 4.8 billion tons.

Note: The "Statistical Bulletin on the Development of the Transportation Industry" issued by the Ministry of Transport has published information on maritime cargo volumes since 2020. As of April 2025, the "2024 Statistical Bulletin on the Development of the Transportation Industry" has not yet been released, and the 2024 data are preliminary forward-looking estimates.

According to statistics from the Ministry of Transport, in 2023, maritime shipping accounted for 95% of China's total foreign trade transport volume. The China Port Operation Analysis Report (2024), released by the Planning and Research Institute of the Ministry of Transport, preliminarily estimates that the total cargo throughput of coastal ports nationwide in 2024 will be approximately 13.57 billion tons. Of this, foreign trade cargo throughput is about 5.12 billion tons, coal and crude oil throughput are about 2.53 billion tons and 780 million tons respectively, and container throughput is about 300 million TEUs, of which international route throughput is approximately 150 million TEUs.

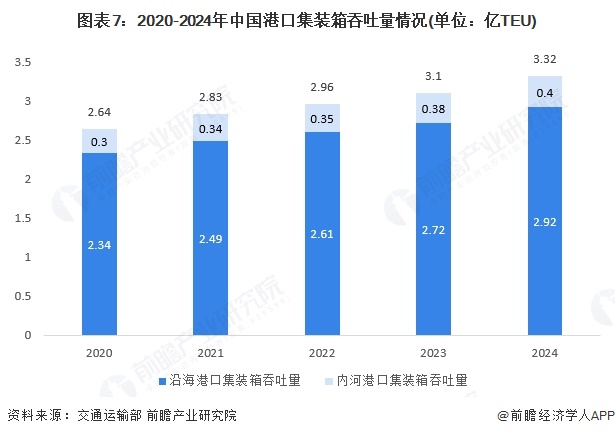

——With the recovery of foreign trade demand, container throughput at Chinese ports continues to grow

Driven by the recovery of foreign trade demand, according to data released by the Ministry of Transport, in 2023, container throughput at Chinese ports historically surpassed 300 million TEUs, a year-on-year increase of 4.7%. In 2024, the main Chinese ports continue to maintain good operational performance, and freight container volume continues to grow, with container throughput at Chinese ports reaching 332 million TEUs, of which coastal port container throughput reaches 292 million TEUs.

International Freight Forwarding Market Analysis

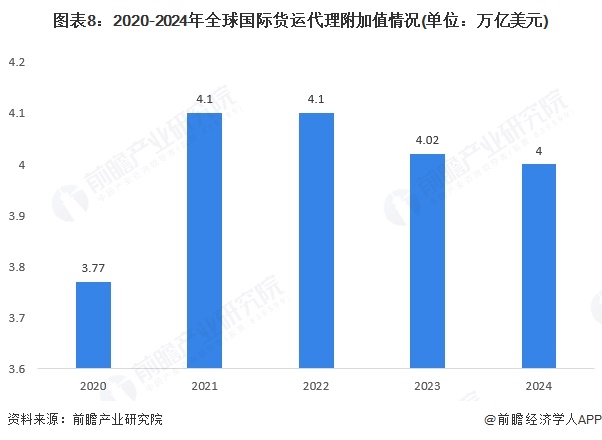

International sea freight forwarding refers to individuals or companies who, within the scope of legal authorization, accept commissions from shippers and handle various maritime cargo-related services on their behalf, including customs declaration, delivery, warehousing, allocation, inspection, packaging, containerization, transshipment, and booking. From 2020 to 2024, the global added value of international freight forwarding first increased and then decreased. In 2023-2024, influenced by factors such as the Red Sea crisis, liner companies saw annual revenue growth, marking the end of the era of high profits for freight forwarders. The global added value of international freight forwarding declined for two consecutive years, dropping to $4 trillion in 2024.

Container Shipping Digital Market Analysis

The advantages of digital freight are becoming increasingly evident, with considerable market growth potential.

In recent years, international shipping service platforms have rapidly developed under the drives of digitalization, intelligence, and globalization, becoming a core force in promoting industry transformation and upgrading. With the continuous growth of global freight demand, the advantages of digital freight are increasingly obvious. Through digital platforms, shippers and freight forwarders can obtain quotes more quickly, while carriers can use digital tools to improve efficiency and customer experience.

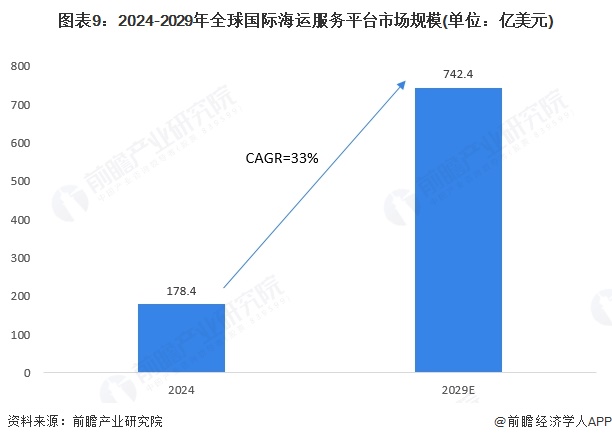

As global demand for efficient, real-time freight solutions continues to grow and technological advancements optimize logistics operations, the global market size of international freight service platforms continues to expand. In 2024, the global market size of international freight service platforms is estimated at approximately $47.31 billion, with the maritime sector still in the early stages of digital transformation. Digital freight forwarders, relying on the technological support of international freight service platforms, show that the demand for digital freight in the maritime sector accounts for about 37.7% in 2024. Based on this, the global maritime service platform market size in 2024 is estimated to reach $17.84 billion. From 2024 to 2029, the global international maritime service platform market is expected to grow at a compound annual growth rate of 33%, reaching $74.24 billion by 2029.

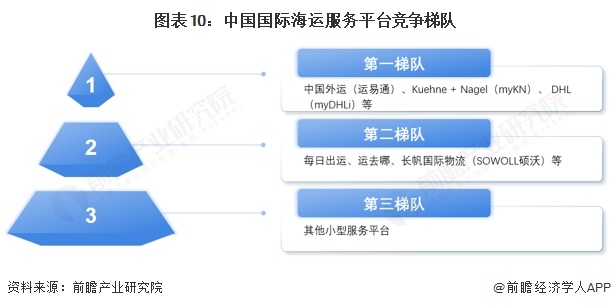

The Chinese international shipping service platform market can be divided into three tiers.

Overall, the international shipping service platform market can be divided into three tiers based on factors such as company size, number of clients, platform scale and resources, and platform service areas. The first tier mainly includes globally leading freight forwarding companies that have developed comprehensive service platforms with global capabilities, such as Sinotrans (Easytogo), Kuehne + Nagel (myKN), and DHL (myDHLi). The second tier mainly consists of innovative platforms focusing on vertical markets, such as Daily Shipping, Yunquna, and Changfan International Logistics. The third tier consists primarily of other smaller international shipping service platforms. In the first tier, Sinotrans, for example, dominates due to its strong transport capacity resources and global network, holding a higher market share. Daily Shipping's strength lies in its in-depth service capabilities within the vertical sector, leading the second tier in terms of both the number of shipping companies it collaborates with and the number of clients it serves in the container shipping field.

Disclaimer: All content on this website is reproduced from other online media and does not represent this website's endorsement of the opinions expressed, nor do we take responsibility for their accuracy. If there is any infringement, please contact us promptly, and we will remove it immediately!

- Business Manager:Nancy He

- +86 181 1254 8750

- Nancy.he@novoscm.cn

- Read more

CONTACT MESSAGE in China:

CONTACT MESSAGE in HongKong and Thailand

![]() Ben

Ben

![]() +66 0650307886

+66 0650307886

![]() ben@novoscm.cn

ben@novoscm.cn